✔ Awesome-Avalonia PRs Welcome

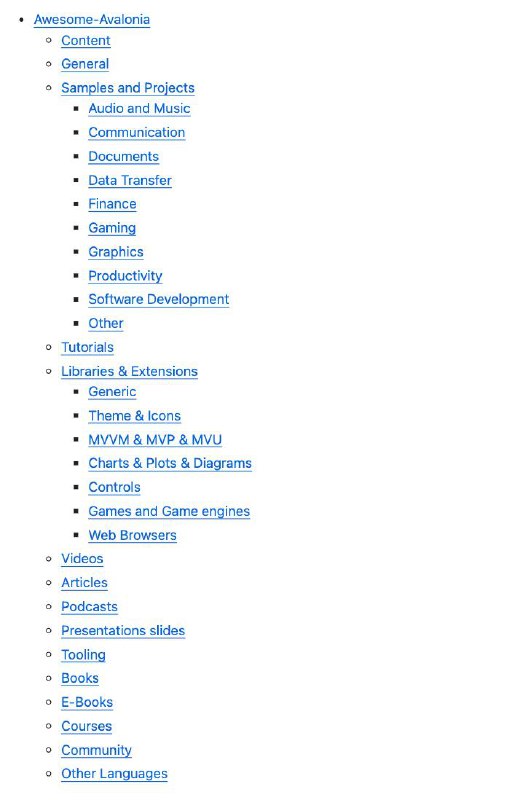

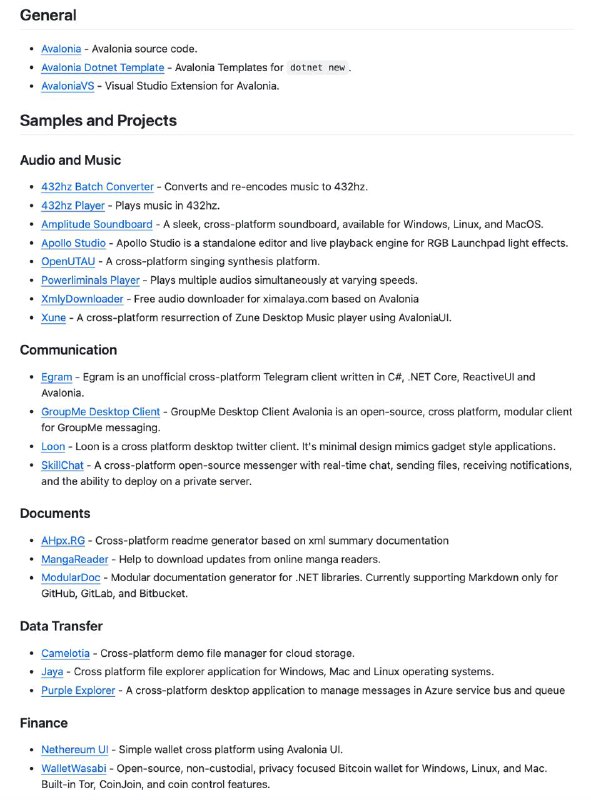

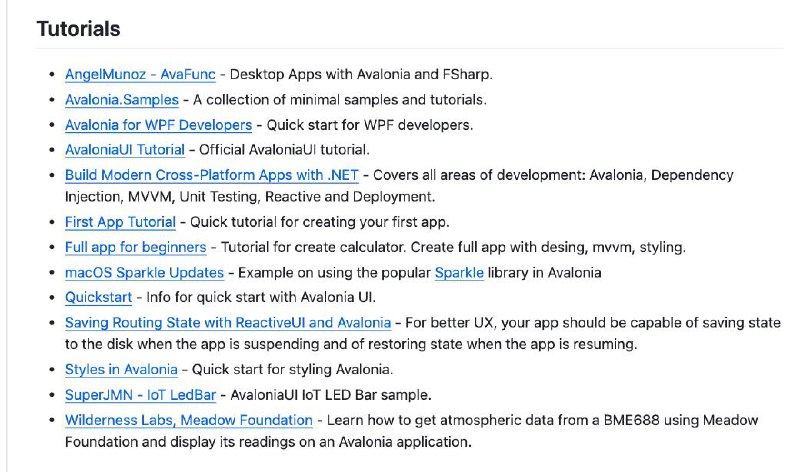

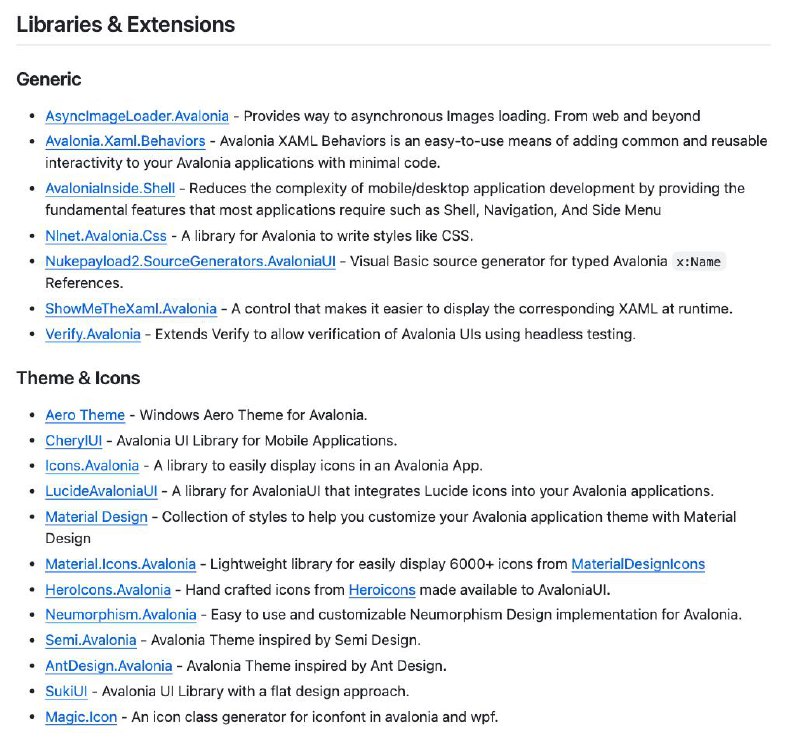

Коллекция полезных библиотек и инструментов для проекта Avalonia включает в себя множество полезных ресурсов.

Если вы работаете с кроссплатформенным XAML-фреймворком для экосистемы .NET, то репозиторий awesome-avalonia заслуживает вашего внимания. Он содержит множество полезной информации и будет отличным дополнением к вашим закладкам.

▪ GitHub

Коллекция полезных библиотек и инструментов для проекта Avalonia включает в себя множество полезных ресурсов.

Если вы работаете с кроссплатформенным XAML-фреймворком для экосистемы .NET, то репозиторий awesome-avalonia заслуживает вашего внимания. Он содержит множество полезной информации и будет отличным дополнением к вашим закладкам.

▪ GitHub

tg-me.com/csharp_1001_notes/549

Create:

Last Update:

Last Update:

✔ Awesome-Avalonia PRs Welcome

Коллекция полезных библиотек и инструментов для проекта Avalonia включает в себя множество полезных ресурсов.

Если вы работаете с кроссплатформенным XAML-фреймворком для экосистемы .NET, то репозиторий awesome-avalonia заслуживает вашего внимания. Он содержит множество полезной информации и будет отличным дополнением к вашим закладкам.

▪ GitHub

Коллекция полезных библиотек и инструментов для проекта Avalonia включает в себя множество полезных ресурсов.

Если вы работаете с кроссплатформенным XAML-фреймворком для экосистемы .NET, то репозиторий awesome-avalonia заслуживает вашего внимания. Он содержит множество полезной информации и будет отличным дополнением к вашим закладкам.

▪ GitHub

BY C# 1001 notes

Share with your friend now:

tg-me.com/csharp_1001_notes/549